Bank Income

Learn about Bank Income features and implementation

API Reference

View Income requests, responses, and example code

View Income APIQuickstart

View the starter Income sample app and code

View Income QuickstartOverview

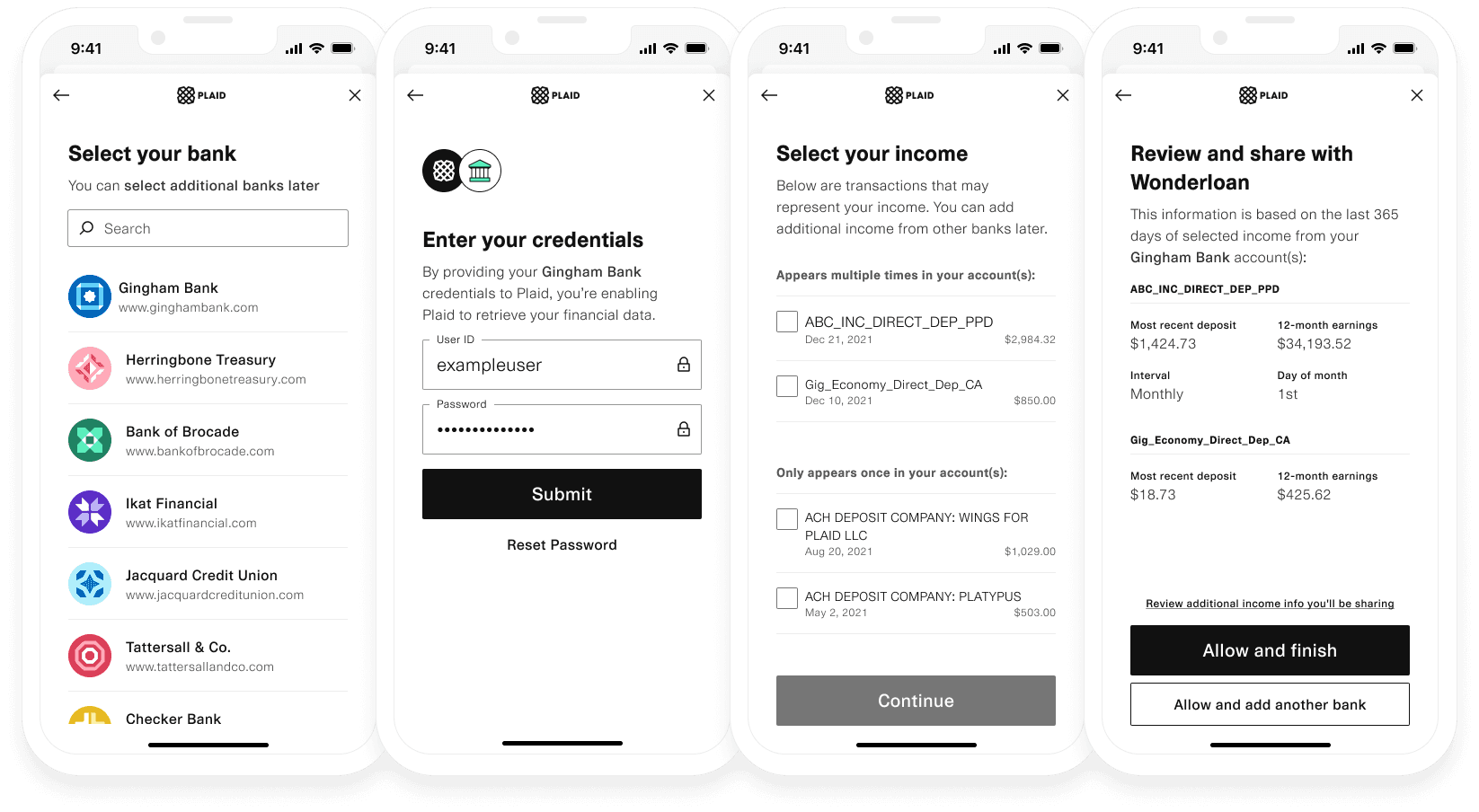

Bank Income allows you to instantly retrieve net income information from a user-connected bank account, supporting both irregular or gig income and W-2 income. Data available includes a breakdown of income streams to the account, as well as recent and historical income.

Integration process

- Call

/user/createto create auser_tokenthat will represent the end user interacting with your application. This step will only need to be done once per end user. If you are using multiple Income types, do not repeat this step when switching to a different Income type. - Call

/link/token/create. In addition to the required parameters, you will need to provide the following:- For

user_token, provide theuser_tokenfrom/user/create. - For

products, use["income_verification"]. You can also specify additional products. For more details, see Using Bank Income with other products. - For

income_verification.income_source_types, usebank. - Set

income_verification.bank_income.days_requestedto the desired number of days. - Provide a

webhookURI with the endpoint where you will receive Plaid webhooks. - If enabling a multi-Item session, set

income_verification_bank_income_multiple_itemsto true. For details, see Multi-Item sessions.

- For

- On the client side, create an instance of Link using the

link_tokenreturned by/link/token/create; for more details, see the Link documentation. - Open Link in your web or mobile client and listen to the

onSuccessandonExitcallbacks, which will fire once the user has finished or exited the Link session. - If you are using other Plaid products such as Auth or Balance alongside Bank Income, call

/credit/sessions/getand make sure to capture eachpublic_tokenfrom theitem_add_resultsarray. Exchange eachpublic_tokenfor anaccess_tokenusing/item/public_token/exchange. For more details on token exchange, see the Token exchange flow. - To retrieve data, call

/credit/bank_income/getwith theuser_token.

Multi-Item sessions

Many users get income deposited into multiple institutions. To help capture a user’s full income profile, you can allow your users to link multiple accounts within the same link session on web integrations.

To enable this flow, when calling /link/token/create set the bank_income.enable_multiple_items option to true.

Using Bank Income with other products

Bank Income Items are fully compatible with other Plaid Item-based products, including Auth, Transactions, Balance, and Assets.

When initializing Link, if you plan to use Bank Income and Assets in the same session, it is recommended to put both income_verification and assets in the /link/token/create products array. If you plan to use Bank Income with Transactions, you should not put transactions in the products array, as this may increase latency. For more details, see Choosing how to initialize Link.

To capture an access_token for use with other products, call /credit/sessions/get after receiving the onExit or onSuccess callback from Link. This endpoint will return all public_tokens for every Item linked to a given user_token. For details on the API schema, see the /credit/sessions/get documentation. You can then exchange these public_tokens for access_tokens using /item/public_token/exchange.

Verifying Bank Income for existing Items

If your user has already connected their depository bank account to your application for a different product, you can add Bank Income to the existing Item via update mode.

To do so, in the /link/token/create request described above, populate the access_token field with the access token for the Item. If the user connected their account less than two years ago, they can bypass the Link credentials pane and complete just the Income Verification step. Otherwise, they will be prompted to complete the full Plaid Bank Income Link flow.

Bank Income Refresh

Bank Income Refresh is available as an optional add-on to Bank Income. With Bank Income Refresh, you will be able to get updated income data for a user. Existing income sources will be updated with new transactions, and new income sources will be added if detected.

To implement Bank Income Refresh:

On the webhooks page in the Dashboard, enable Bank Income Refresh webhooks and (optionally) Bank Income Refresh Update webhooks.

Call

/credit/bank_income/refreshwith theuser_tokenfor which you want an updated report.A

BANK_INCOME_REFRESH_COMPLETEwebhook will notify you when the process has finished. If the value of theresultfield in the webhook body isSUCCESS, the report was updated. If it wasFAILURE, send the user through update mode and then try calling/credit/bank_income/refreshagain.If the report was updated, when you next call

/credit/bank_income/getor/credit/bank_income/pdf/get, the refreshed version of the report will be returned. To see old versions of the report, call/credit/bank_income/getwith theoptions.countparameter set to a number greater than 1.

Bank Income update notifications

To alert you to when you might want to call /credit/bank_income/refresh, Income can send webhooks when a change has been detected in the user's income.

To subscribe to these notifications:

- On the webhooks page in the Dashboard, enable Bank Income Refresh Update webhooks.

- Call

/credit/bank_income/webhook/updatewith theuser_tokenyou would like to enable andenable_webhooks: true.

A BANK_INCOME_REFRESH_UPDATE webhook will then be sent if any of the following occur:

- A new income stream has been detected

- An existing income steam has been updated with new transactions

- An existing income stream appears to have stopped

Institution coverage

To determine whether an institution supports Bank Income, you can use the Dashboard status page (look for "Bank Income") or the /institutions/get endpoint (look for or filter by the income_verification product). The income product returned by these surfaces represents a legacy product and does not indicate coverage for Bank Income.

Testing Bank Income

Income can be tested in Sandbox against test data without contacting Plaid. In order to test Income against live Items in either Development or Production, you will need to first request access by submitting a product access request Support ticket explaining your use case.

To help you test Bank Income, Plaid provides a custom Sandbox user with Bank Income. To use the custom user, select a non-OAuth institution within Link and use username user_bank_income and password {}. This will provide up to two years of income data with various income categories and pay frequencies. The basic Sandbox credentials (user_good/pass_good) will not return data when used to test Bank Income.

If you’d like to test Bank Income with custom data, Plaid also provides a test JSON configuration object. To load this data into Sandbox, update the JSON object so that all transaction dates are within the date range requested and then copy and paste the JSON into the Sandbox Users pane in the Dashboard.

/credit/bank_income/get can optionally be tested in Sandbox without using Link. Call /user/create and pass the returned user_token to /sandbox/public_token/create. /sandbox/public_token/create must be called with the following request body:

1{2 "client_id": "${PLAID_CLIENT_ID}",3 "secret": "${PLAID_SECRET}",4 "institution_id": "ins_20", //any valid institution id is fine5 "initial_products": ["income_verification"],6 "user_token": "user-token-goes-here", //use the user_token from the `/user/create` call made earlier7 "income_verification": {8 "income_source_types": ["bank"],9 "bank_income": {10 "days_requested": 180 //any number of days under 730 is valid11 }12 },13 "options": {14 "override_username": "user_bank_income",15 "override_password": "{}"16 }17}After calling /sandbox/public_token/create, call /credit/bank_income/get using the same user_token. The output of /sandbox/public_token/create will not be used, but calling it initializes the user token for testing.

Bank Income pricing

Bank Income is billed on a one-time fee model. Bank Income Refresh is billed on a per-request fee model To view the exact pricing you may be eligible for, apply for Production access or contact Sales. For more details about pricing and billing models, see Plaid billing.

Next steps

If you're ready to launch to Production, see the Launch checklist.